The Mysteries of the Goldman Sachs Partnering Process, Revealed

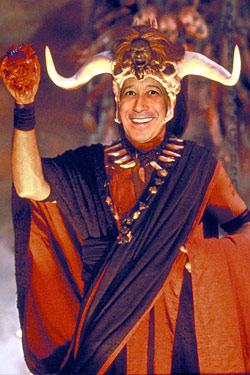

Photo-illustration: Lucasfilm Ltd./Paramout/The Kobal Collection, Patrick McMullan

By: Jessica Pressler NY Mag

Like an emotionally distant lover, the less Goldman Sachs gives us, the more we want. In today's New York Times, a Goldman spokesman declined to comment on the process by which the firm annually selects its partners, leading the Times to describe the process as "secretive" and driving us wild with curiosity. What kinds of sick things do they make potential partners do, for the firm to decline to speak about it entirely? What secrets lurk in the hearts of the hordes streaming in and out of the building on West Street? We asked a former Goldman Sachs partner to describe how this mysterious ritual works.

All right. Let's do this. How does the super-secret selection process work? Don't worry about shocking me, I have a strong stomach.

You basically have to get nominated by the head of your division and then they go through some vetting process, in which they look at your reviews and solicit other partner's opinions and input.So it's like going through rush at a fraternity, a little.

I guess so. I've never done that.Is there a hazing component? Is it, like, the head of your division drives you to a nursing home and goes, "Sell this worthless financial product to everyone inside or else I'll strip you naked and tie you to the top of the Empire State Building"?

No, you don't have to perform any feats. It's more like, how effective are you? Do you contribute a lot to the P&L? Do you have the support of the people who run your area and your division?Intense. So then what happens? How do you find out you've made partner? Do they wheel a giant cake into your office, made entirely out of $100 bills, with a hooker inside?

Actually, um, you get a call from the head of the firm that morning telling you that you’ve been elected partner of the firm. That’s the notification. Then they put out a list an hour or so later.Do they give you anything to seal the deal? A briefcase full of cash? A couple of gold bars? Naming rights to the junior associates' first-born?

When I was made partner it was before they went public, so the financial rewards were quite significant. You literally owned a piece of the firm. And when it went public it was very lucrative, of course. It's less so now, because they have to give the shareholders some return on their investment.

Read the rest of the interview here

1 COMMENTS:

Has anyone noticed all the grovelling being displayed on cnbc by big and small names trying to convince the world what a great service they perform in the markets....man they really must love their gravy train!

You know somethings up with that....

Post a Comment