Goldman Sachs & Co., a unit of the most profitable bank in Wall Street history, took $15 billion from the U.S. Federal Reserve on Dec. 9, 2008, the biggest single loan from a lending program whose details have been secret until today.Since the Supreme Court of the United States ruled that Federal Reserve information has to be made available under the Freedom Of Information Act (FOIA), Bloomberg, who has a history of attempting to obtain information about "The Fed", was able to get this information.

The central bank resisted previous FOIA requests on emergency lending for more than two years, disclosing details in March of its oldest loan facility, the discount window, only after the U.S. Supreme Court ruled it had to. When Congress mandated the December 2010 release of data on special initiatives the Fed created in its unprecedented $3.5 trillion response to the 2007-2009 collapse in credit markets, ST OMO -- an expansion of a longstanding program -- wasn’t included.While this may or may not be surprising to any of you - it was not to me - what is interesting is the connections at the time.

These loans were made through none other then the unofficial leader of "The Fed" - The New York Federal Reserve Bank". (Be careful here, as here comes a conspiracy theory). If the N.Y. Fed seems to have so much control of the entire Fed system and the Chairman of the Board of J.P. Morgan Chase always has a seat on the Board of the NY Fed Bank how much control does JP Morgan/Chase have? Hmmm, do JP and GS rule?

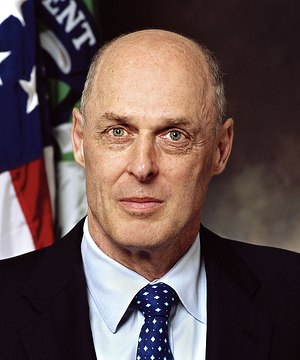

OK, enough of conspiracy theories and back to questions of facts as exist. At the time of these "secret" low interest loans the President of the NY Fed was none other them Timothy Geithner. At that time (the very end of the Bush administration) the Secretary of the U.S. Treasury was our old friend Hank Paulson who as we all know was Chairman and CEO of Goldman prior to his taking the "public service" job.

Many of you know from previous posts I have made and from my posts over at www.BarackObama666.blogspot.com, that I am not a fan of The Federal Reserve System as it is set up today. I am not in favor of it being a private enterprise - not a government agency - and I am not in favor of its' secretive policies and operations that still exist today even with the Congressional and Supreme Court rulings.

More and more, I see this connection between Goldman, The Fed and JP Morgan. I see connections between the revolving door between Central Banks (worldwide) as well as Government jobs (worldwide) and specifically Goldman Sachs. While I don't have as much research on the topic, I have seen this connection with J.P. Morgan/Chase as well to a lesser extent.

Here now a very interesting video published on YouTube but brought to my attention when posted by The Daily Bail.

The Daily Bail proclaims this as "The most important video they have ever posted". I would have to say it is the most definitive one posted showing how corrupt and secretive The Fed really is.

WHO IS KEEPING TRACK OF THE TRILLIONS?For more interesting videos...click here

Start watching at the 3-minute mark. The action begins soon after. At issue is the accounting and oversight for $9 trillion in secret Fed bailouts of Wall Street banks, for which taxpayers are ultimately responsible to the tune of $32,000 for every man, woman and child in this country. Fed audit, anyone?

The crimes continue and continue to go unpunished. Our Congress is more obsessed with prosecuting Roger Clemens for lying to Congress about his drug use. They don't seem to care about the Bernankes, the Paulson's, the Geithner's, the Blankfeins, the Dimon's and all the rest who so successfully ripped us all off, ruined our nation and affected the economies worldwide by their frauds and deceits. Then when questioned, like in the video above, they lie to Congress but of course, no prosecution for these lies.

This man orchestrated one of the biggest crimes in the history of the world. He favored his former comrades while in office and often lied to Congress, the People and the world. Yet his lies go unpunished. Better we send a baseball player to prison for 30 years because he took a drug to gain an unfair advantage in a "game" then lied about doing it. Where is the national harm he caused and WHY was our Congress even involved in questioning him. HE WAS A PLAYER IN A GAME that had no effect on our lives, our economy or our homes.

Image via Wikipedia Image via Wikipedia |

| Is this a face you can trust? |

Image via Wikipedia Image via Wikipedia |

| Is this a face you can trust? |

Yup, let's let the real criminals walk free but put the baseball player in jail.

Our criminal justice system seems to lack the justice they are supposed to protect and seem to exhibit the criminal tendencies they are supposed to protect us from. The "criminal justice system" just another oxymoron.

Wake Up America!

2 COMMENTS:

Here's your connection to jpm...

SEC Charges JPM with Regularly Rigging Muni Bond Markets Across the Country For Years

Such serious charges that are settled with fines and no admission of guilt despite overwhelming evidence of a criminal conspiracy, often initiated by the States, is a merely the cost of doing business when one is occasionally discovered in an ongoing confidence game. This global banking game robs billions from the public on a regular basis across a wide range of financial and commodity markets.

The fines are paid, a highly compensated individual takes the nominal 'punishment' while keeping the proceeds, the politicians and regulators are paid, and the fraud continues on.

http://jessescrossroadscafe.blogspot.com/2011/07/sec-charges-jpm-with-rigging-muni-bond.html

THEY ARE A FAMILY IN AND OF CRIME!!PURE AND SIMPLE...HOW CAN ANY THINKING, UNBIASED PERSON REFUTE IT!!

Jamie Dimon’s House of Ill Repute

The BP of Banking

Clearly, JPMorgan is not alone in paying big fines. UBS and Bank of America both paid fines related to muni bond rigging while Goldman Sachs got tagged with a $550 million fine for the "Abacus″ transaction that was very similar to JPMorgan's Magentar deal.

Every Wall Street firm has paid significant fines during the past decade but JPMorgan is starting to look the BP of banking.

http://finance.yahoo.com/blogs/daily-ticker/taken-task-jamie-dimon-house-ill-repute-160317480.html

Post a Comment