In contrast with the top 10 big banks in the US, who were not allowed to fail, are the smaller banks who are failing weekly. According to Wikipedia, there have been about 346 banks under the auspices of the FDIC that have failed since 2008, most of them failing in 2010. In 2008, 26 banks failed; in 2009, 140 banks failed; in 2010, 157 banks failed; in 2011, 23 banks have failed so far.

Here's americanpendulum on

Banking Mammoths - Top 10 U.S. banks have $11 trillion of the $13 trillion in total banking assets. The problem? We have over 7,650 banks. The banking oligopoly leads to a concentration of wealth at the top

by mybudget360

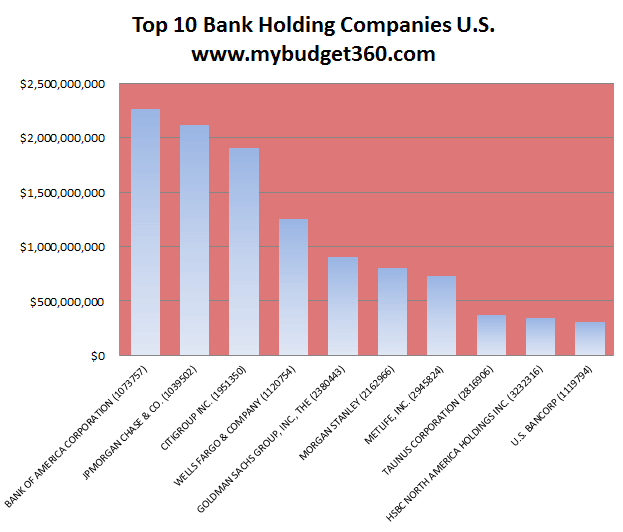

The too big to fail problem is still an issue that needs to be dealt with even though many would like to ignore it like a big dark secret. The FDIC is holding up a system with $5.4 trillion in deposits and no deposit insurance fund. I know a lot of Americans have a hard time believing this but this is a cold hard fact. The entire banking edifice of our nation is held up on pure faith combined with the backing of our largest banks and government. This wouldn’t be such an issue if banks operated as responsible stewards of the economy but instead they have used the taxpayer wallet as some kind of endless buffet piggybank. What is even more troubling is based on the latest data, the top 10 bank holding companies in the United States are reporting $11 trillion dollars in assets. Now why is this a problem? The FDIC insures 7,657 banks with $13 trillion in assets. In other words, over 84 percent of all banking assets are in the hands of the big ten banks. This is a modern day oligopoly. Take a look at this chart for the top 10 banks:

Read the full article hereAs of Q4 2010

This sort of distribution does not bode well for our economy. We have witnessed what happens when giant banks fail because they were allowed to grow too large for their own good. A sort of disequilibrium occurs and if things collide as they usually do the taxpayer is left holding the bag of junk debt. Every week one or two smaller banks fail almost without any news. This is really how our economy should work. Banking assets should be distributed in a more even fashion where if the biggest bank failed, there would be enough banks with enough assets to make up for the lost services provided by the one bank. It would not be a systemic problem. But many of the too big to fail incur large amounts of leverage so are in debt to even more than the face value of their assets. It is a thinly veiled method of speculation with the implicit support of the American taxpayer. As the gambling gets more intense, so does the wealth evaporation in the real economy.

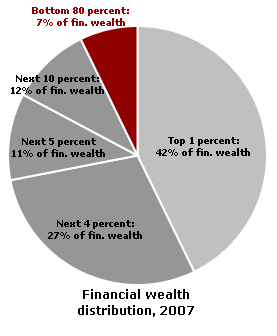

These kinds of distributions create incredible amounts of problems. Take for example how financial wealth is distributed in the U.S.:

Source: William Domhoff

The top 1 percent in the United States control 42 percent of all financial wealth. But breaking it down further we realize that the top 10 percent control 93 percent of all financial wealth. This kind of imbalance was last seen in the United States right before the Great Depression hit. It is a historical irony that during the Great Depression many people started feeling wealthier because they were getting into massive amounts of consumer debt (nothing like today) and had the ability to speculate in the stock market on margin. While it was estimated that only 1 million Americans dabbled in the stock market at that time, most of the wealth again was aggregated at the top as it is today. The vast majority where only spectators buying a lottery ticket for the get rich show. Most Americans are leveraged to the hilt with debt while true unencumbered financial wealth keeps trickling to a very small segment of our economy. While some would argue this is the end result of unfettered capitalism the reality is the wealth is being siphoned off from the productive public by this elite class buying off politicians and creating a system favorable to those with means and not with the best or most innovative idea. It is a plutocracy and these kinds of systems do not last. Right now the growth of the plutocracy is occurring on the backs of the dwindling middle class.

5 COMMENTS:

There's a related article today on Alternet about the same subject-

http://www.alternet.org/economy/150099/the_astonishing_stupidity_of_not_raising_taxes_on_the_rich_when_budgets_are_tight/

One of the leading business schools in America - the Wharton School of Business - published an essay by a psychologist on the causes and solutions to the economic crisis. Wharton points out that restoring trust is the key to recovery, and that trust cannot be restored until wrongdoers are held accountable:

According to David M. Sachs, a training and supervision analyst at the Psychoanalytic Center of Philadelphia, the crisis today is not one of confidence, but one of trust. "Abusive financial practices were unchecked by personal moral controls that prohibit individual criminal behavior, as in the case of [Bernard] Madoff, and by complex financial manipulations, as in the case of AIG." The public, expecting to be protected from such abuse, has suffered a trauma of loss similar to that after 9/11. "Normal expectations of what is safe and dependable were abruptly shattered," Sachs noted. "As is typical of post-traumatic states, planning for the future could not be based on old assumptions about what is safe and what is dangerous. A radical reversal of how to be gratified occurred."

People now feel more gratified saving money than spending it, Sachs suggested. They have trouble trusting promises from the government because they feel the government has let them down.

He framed his argument with a fictional patient named Betty Q. Public, a librarian with two teenage children and a husband, John, who had recently lost his job. "She felt betrayed because she and her husband had invested conservatively and were double-crossed by dishonest, greedy businessmen, and now she distrusted the government that had failed to protect them from corporate dishonesty. Not only that, but she had little trust in things turning around soon enough to enable her and her husband to accomplish their previous goals.

"By no means a sophisticated economist, she knew ... that some people had become fantastically wealthy by misusing other people's money -- hers included," Sachs said. "In short, John and Betty had done everything right and were being punished, while the dishonest people were going unpunished."

Helping an individual recover from a traumatic experience provides a useful analogy for understanding how to help the economy recover from its own traumatic experience, Sachs pointed out. The public will need to "hold the perpetrators of the economic disaster responsible and take what actions they can to prevent them from harming the economy again." In addition, the public will have to see proof that government and business leaders can behave responsibly before they will trust them again, he argued.

http://www.zerohedge.com/article/top-economists-trust-necessary-stable-economy-trust-wont-be-restored-until-we-prosecute-wall

The summary is wrong. The top 10% control 80% of wealth based on the studies figures. Strange a financial study gets this wrong.

"Thanks, Anonymous, for the correction. I should have noticed it too. Still the inequality is egregious even with the revised figures.

Zerohedge, I like what you say about trust and your article is worth reading.

Post a Comment